Driven by science, trusted by business

Join the organizations committed to change

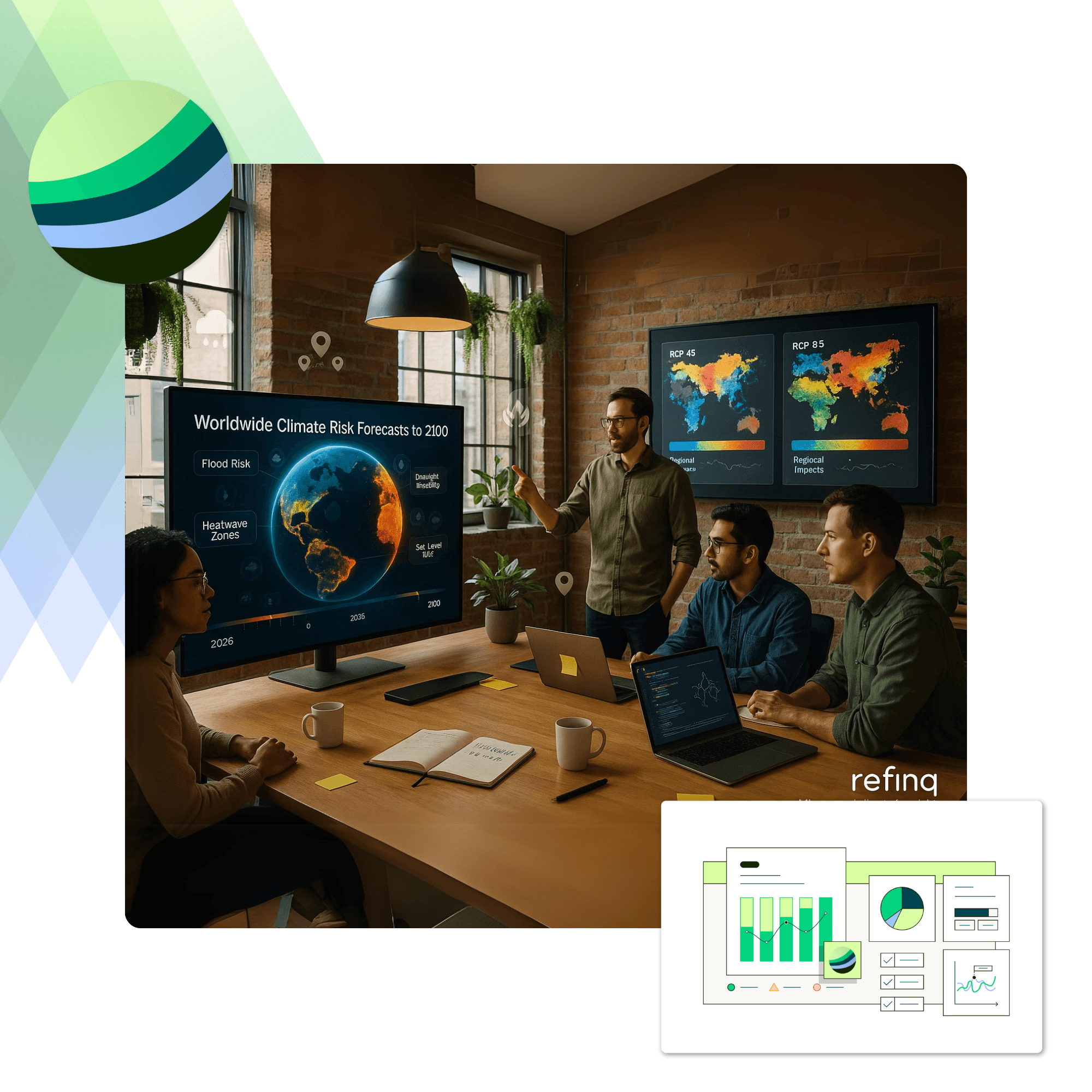

Pioneering climate

risk assessments

refinq - Nature and climate risk solution platform for enterprises

Driven by science, trusted by business

Join the organizations committed to change

Physical risks overview

How refinq works

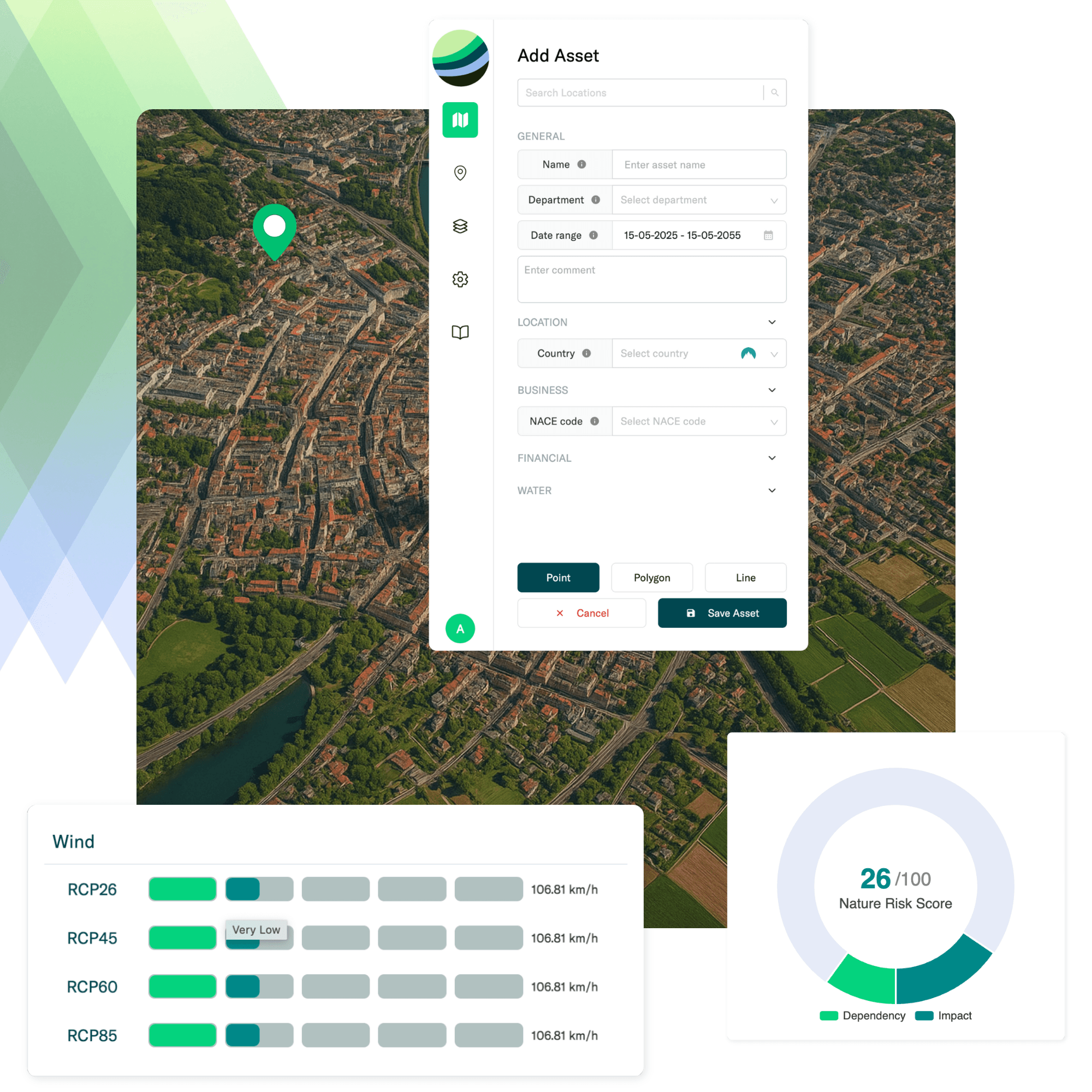

Minimal inputs per asset

Location | Coordinates | Address | Shape

Business Activity | NACE Code | EU Taxonomy

Optional inputs: Time horizon | Monetary value

Extensive Data

Different climate scenarios until the year 2100

Worldwide coverage for all risks

Proprietary machine learning model based on latest scientific discoveries

Transparent results

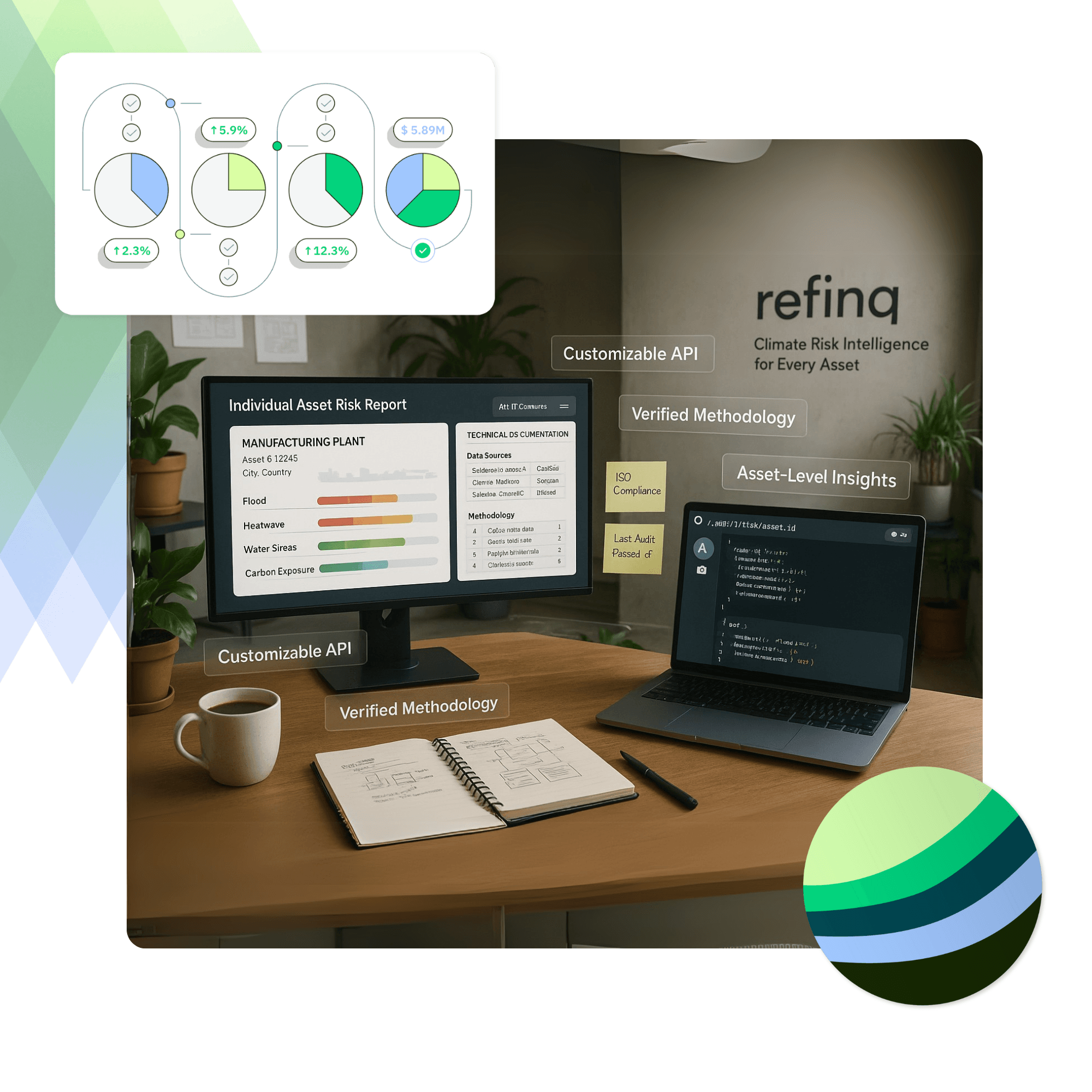

Individual reports

Detailed assessment of the potential risks for each asset

Audit compliance

Thorough documentation of each data source and methodology

API Interface

Seamlessly integrate our climate risk data with your existing systems through a customizable API interface

As climate change intensifies, businesses are grappling with a new challenge—how climate risk and monetary policy intersect. The "climate risk-taking channel" shows how central bank decisions, such as changes in interest rates, can impact companies, particularly those with a high carbon footprint. Explore how businesses can navigate the dual pressures of climate risks and tightening monetary policy.

Read more

With record heatwaves in 2024, businesses face disruptions in supply chains and workforce productivity. Learn how refinq helps companies build resilience against extreme heat risks.

Read more

Natural disasters are on the rise, driving record financial losses. Discover how refinq’s climate risk assessments can help protect your business and future-proof your investments.

Read more

Drought is becoming a persistent crisis across Europe, with severe impacts on ecosystems, agriculture, and economies. As climate change accelerates, regions like Southern Europe face worsening water stress, crop failures, and energy shortages. The economic toll could quintuple by 2100 with continued warming. Megadroughts and cascading risks like wildfires add to the urgency for action.

Read more

FAQ

Frequently asked questions answered

What is refinq and how does it support nature and climate risk management?

refinq is a Software as a Service (SaaS) platform that translates complex environmental data into nature and climate risk profiles, and provides recommendations for action that can be deployed by corporates.

We assist businesses in assessing and managing nature and climate risks across their assets, ensuring compliance with frameworks like TNFD, CSRD, and ESRS, reducing business operating costs, and future-proofing supply chains. refinq’s tool expands the reach and effectiveness of corporate nature teams.

How does GaiaGuide enhance refinq's Nature Intelligence Hub?

GaiaGuide is an AI-powered tool within refinq's platform that provides tailored, location-specific nature-positive actions. It goes beyond identifying risks by offering actionable strategies to mitigate them, helping businesses leverage their natural capital for operational resilience.

What types of climate and nature risks does refinq assess?

refinq evaluates a range of climate hazards, including temperature changes, floods, and wind patterns, alongside nature risks like species extinction, land degradation, and biodiversity intactness (and many more). These assessments are location-specific and aligned with global regulatory frameworks.

Is refinq's data compliant with international reporting standards?

Yes, refinq's assessments align with key frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD), Corporate Sustainability Reporting Standard (CSRD), and European Sustainability Reporting Standards (ESRS), ensuring compliance with international regulations.

How granular is the data provided by refinq?

refinq offers hyper-granular data, creating nature assessments for any company location globally with a granularity of up to 25 meters. This allows for precise risk evaluation and management at the asset level.

Can refinq forecast environmental impacts into the future?

Yes, refinq allows for forecasting environmental impacts based on four climate scenarios up to the year 2100. This forward-looking approach aids in long-term strategic planning and risk mitigation.

How does refinq translate environmental risks into financial terms?

refinq provides financial damage estimates for both climate and nature risks, enabling businesses to quantify potential financial impacts and make informed investment and operational decisions.

Is refinq suitable for global operations outside the EU?

Absolutely. refinq's assessments follow international frameworks like TNFD and our data souces have truly global reach.

What industries can benefit from using refinq?

refinq serves a diverse range of industries, including utilities, manufacturing, financial institutions, and more. Any organisation seeking to understand and manage its nature-related risks can benefit from refinq's platform.

How can I get started with refinq?

To begin leveraging refinq's Nature Intelligence Hub and GaiaGuide, you can book a demo through here. This will provide a comprehensive overview of how the platform can be tailored to your organisation's specific needs.

The Nature Tech Intelligence Hub from refinq enables enterprises to move beyond risk measurement—empowering them to act. Our platform helps companies transform climate and biodiversity risks into opportunities to reduce costs, future-proof operations, and stay competitive in a rapidly changing world.

By combining high-resolution geospatial data with AI-powered analytics, we deliver asset-specific insights that support smart decision-making and concrete nature-positive strategies. refinq can ensure your nature team goes far beyond compliance to improve operations, cut costs and protect supply chains.

Key capabilities: Site-specific risk assessments down to 25m resolution, revealing how climate and nature impact individual assets—and what to do about it. Actionable reporting aligned with CSRD, TNFD, and ESRS—giving you compliance and clarity in one place. Built for business relevance and operational efficiency, refinq’s Nature Tech Intelligence Hub empowers organizations to spot risks early, reduce resource dependency, and act on nature as a lever for resilience and value creation.

From science to action—refinq is the missing link between ecological intelligence and enterprise-grade decision-making.

Your assets are exposed to mother nature. It’s time to act.

We use cookies to improve user experience. Choose what cookie categories you allow us to use. You can read more about our Cookie Policy by clicking on Cookie Policy below.

These cookies enable strictly necessary cookies for security, language support and verification of identity. These cookies can’t be disabled.

These cookies collect data to remember choices users make to improve and give a better user experience. Disabling can cause some parts of the site to not work properly.

These cookies help us to understand how visitors interact with our website, help us measure and analyze traffic to improve our service.

These cookies help us to better deliver marketing content and customized ads.