The Financial Domino Effect: Climate Change and the Economy

The Future is Uncertain, But Your Business Doesn't Have to Be

Climate change isn't just an environmental issue—it's a financial one too. A 2022 estimate by the Network for Greening the Financial System (NGFS) reveals that severe weather events cost the world a staggering $275 billion annually. These physical impacts cascade through the economy, disrupting supply chains, labor markets, and financial stability. Businesses, governments, and individuals are all feeling the financial sting, not just through direct damages, but through long-term economic consequences. The NGFS latest report underscores how climate-related risks affect both the supply and demand sides of the economy—making it clear that the financial implications of climate change are complex and far-reaching. Here are the key takeaways from the report and how refinq can help your business navigate these challenges.

The Long-Term Threat: Chronic Climate Impacts

The Unequal Burden of Climate Change

The economic impacts of climate hazards vary by event type. Droughts, for instance, primarily affect water-dependent industries such as agriculture. Storms, on the other hand, can disrupt a broader range of sectors—from manufacturing to services. This wider impact often results in more severe overall economic consequences.

Hidden Costs: Beyond the Deductible

Climate hazards often inflict immediate impacts on the supply side, damaging infrastructure, productive capital, and real estate, which can cripple operations. While insurance may help cover some of the direct financial losses, it often fails to account for the less visible costs, such as uninsured damages, disruptions to supply chains, and labor shortages.

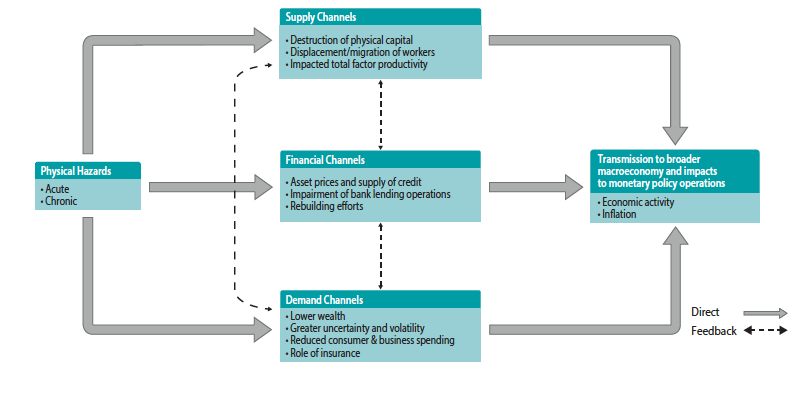

Climate risks ripple through the economy. This flowchart taken from the NGFS Report illustrates the complex interconnectedness.

The Domino Effect: How Climate Risks Impact Your Wallet

Climate-related disruptions can have a cascading effect across the entire economy. Lost productivity, damaged infrastructure, and increased recovery loans for businesses all translate into broader economic consequences. These effects extend beyond the immediately impacted sectors. Tighter credit conditions and weakened financial institutions can slow recovery, driving higher taxes, slower economic growth, and inflation spikes. In fact, inflationary effects, especially in critical sectors like food, can be particularly severe after extreme weather events, with ripple effects on broader price levels.

refinq: Your Climate Risk Guardian

At refinq, we help businesses navigate these complex climate risks. Our innovative climate risk tool provides a comprehensive analysis of various physical climate risks, both acute and chronic. We help businesses understand potential climate change impacts on their assets, infrastructure, and operations, and support informed decision-making for risk management and resilience planning.

What set us apart:

- Tailored Analysis: Provide insights specific to your location, industry, and assets.

- Data-Driven Insights: Leverage cutting-edge data and analytics to provide accurate and reliable results.

Don't Wait Until Disaster Strikes

Proactive adaptation is cheaper than reactive recovery. By anticipating climate risks, you can:

- Reduce insurance premiums

- Secure financing

- Maintain business continuity

- Attract climate-conscious investors

Embrace the Future with Confidence

Climate change presents challenges, but also opportunities. By understanding and mitigating risks, you can position your business for long-term success in a changing world.

Take Action Today!

Contact with refinq today to help you navigate the new climate reality.