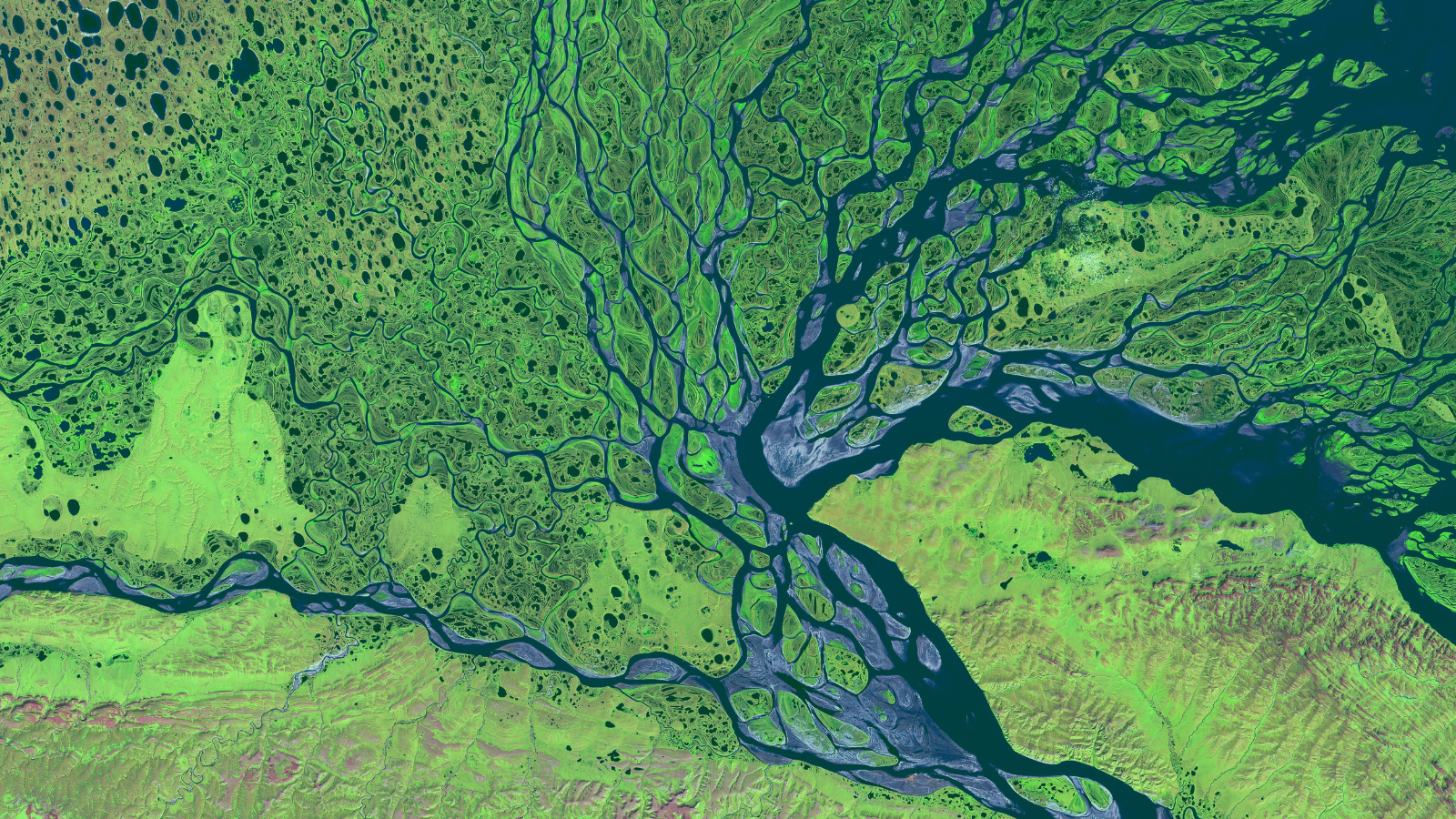

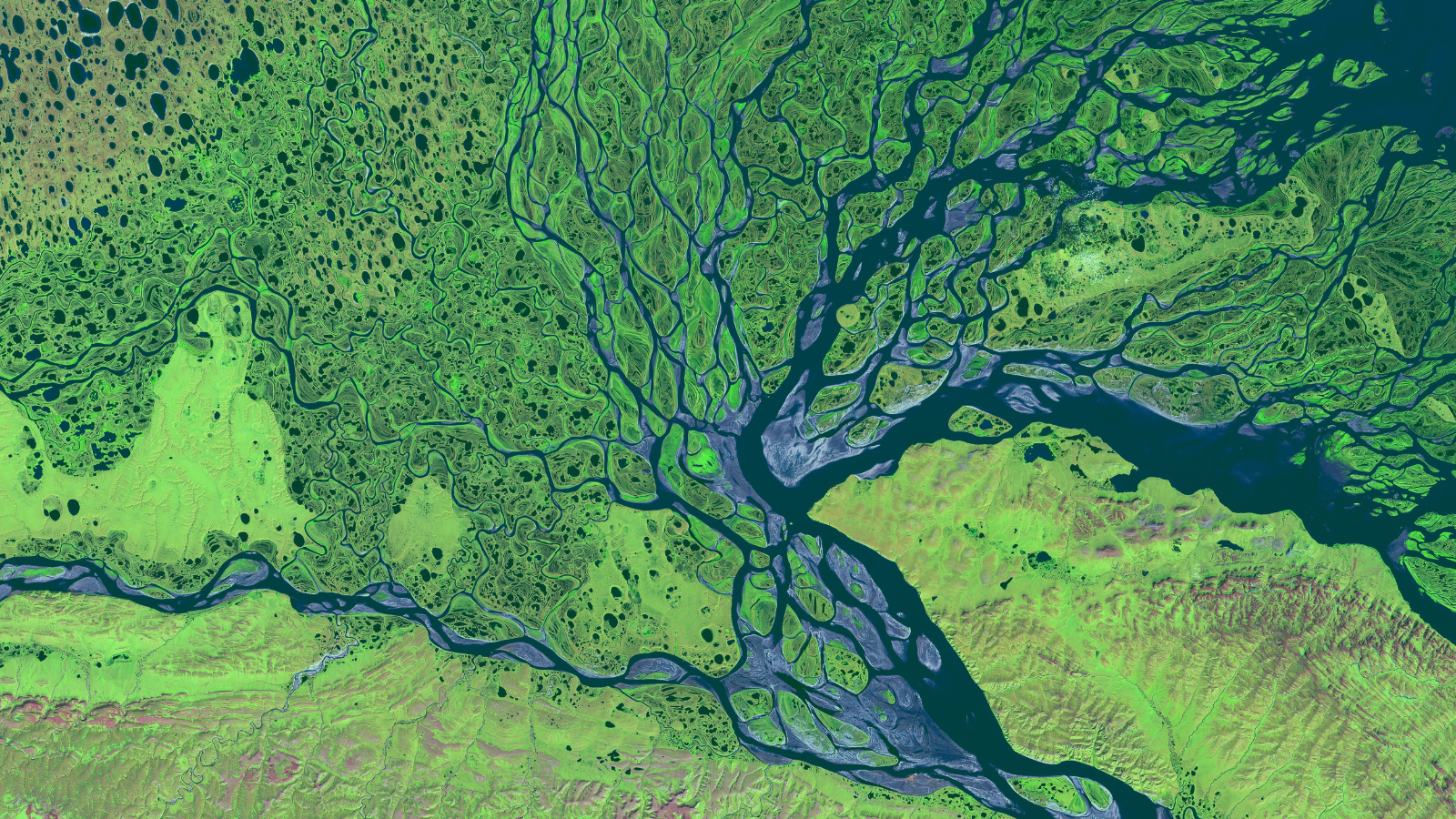

As climate change becomes a more urgent reality, companies face the challenge of adapting their operational and investment strategies to new environmental challenges. A crucial aspect of this adaptation is the strategic use of asset-related data, essential for both understanding the impacts of climate change on corporate values and developing effective risk mitigation and sustainable management strategies.

Companies must protect their assets against losses from a financial perspective. Understanding the specific risks that threaten physical assets, such as floods, droughts, or extreme weather events, is imperative in the rapidly changing climate. This knowledge is a business necessity, especially for assets visibly threatened by physical climate risks. Precise risk assessment using asset-related data allows for the development of targeted adaptation and mitigation measures.

In many regions, including the EU, businesses are mandated to disclose their climate risks. Asset-related data is crucial to comply with these regulations and to report transparently.

Warren Buffett famously said, "It takes 20 years to build a reputation and five minutes to ruin it." Companies cannot afford to neglect proactive engagement with their environmental impact at their locations and within their value chain. Inconsistent, superficial, or absent information could lead to a media backlash, severely damaging the brand.

Transparently presenting measures against climate risks and biodiversity protection significantly strengthens investor trust and enhances the company's market reputation. Neglecting these aspects can deter investors and weaken the investment profile, especially in European and US capital markets.

Proactively and transparently addressing relationships with nature increases a company's attractiveness as an employer. For the increasingly climate-conscious younger generation, this is becoming a decisive factor in choosing an employer. In the current market environment, characterized by significant skills shortages exacerbated by demographic trends, it is vital to position oneself attractively for young talents.

Investors and other stakeholders are focusing more on climate risks and sustainability. Detailed information about company assets is crucial for making informed decisions about investments and long-term strategies.

Modern tools like GIS and AI-powered analysis platforms are indispensable for processing and interpreting large datasets.

Partnerships with specialized data providers can give companies access to high-quality and relevant data.

Asset-related data should be firmly integrated into business strategy to make decisions in line with sustainability goals.

Asset-related data is indispensable in today's business world, providing critical insights into current risks and essential for planning a sustainable future. Companies that effectively utilize this data are better prepared to face the challenges of climate change and secure long-term success.